by MA Yueran

China's storage battery industry is expanding rapidly on the production side, with annual output forecast to surpass 550 GWh in 2025, according to BloombergNEF analyst SHI Jiayan in an interview with Jiemian News and other media. Power battery output is expected to reach nearly 1,000 GWh.

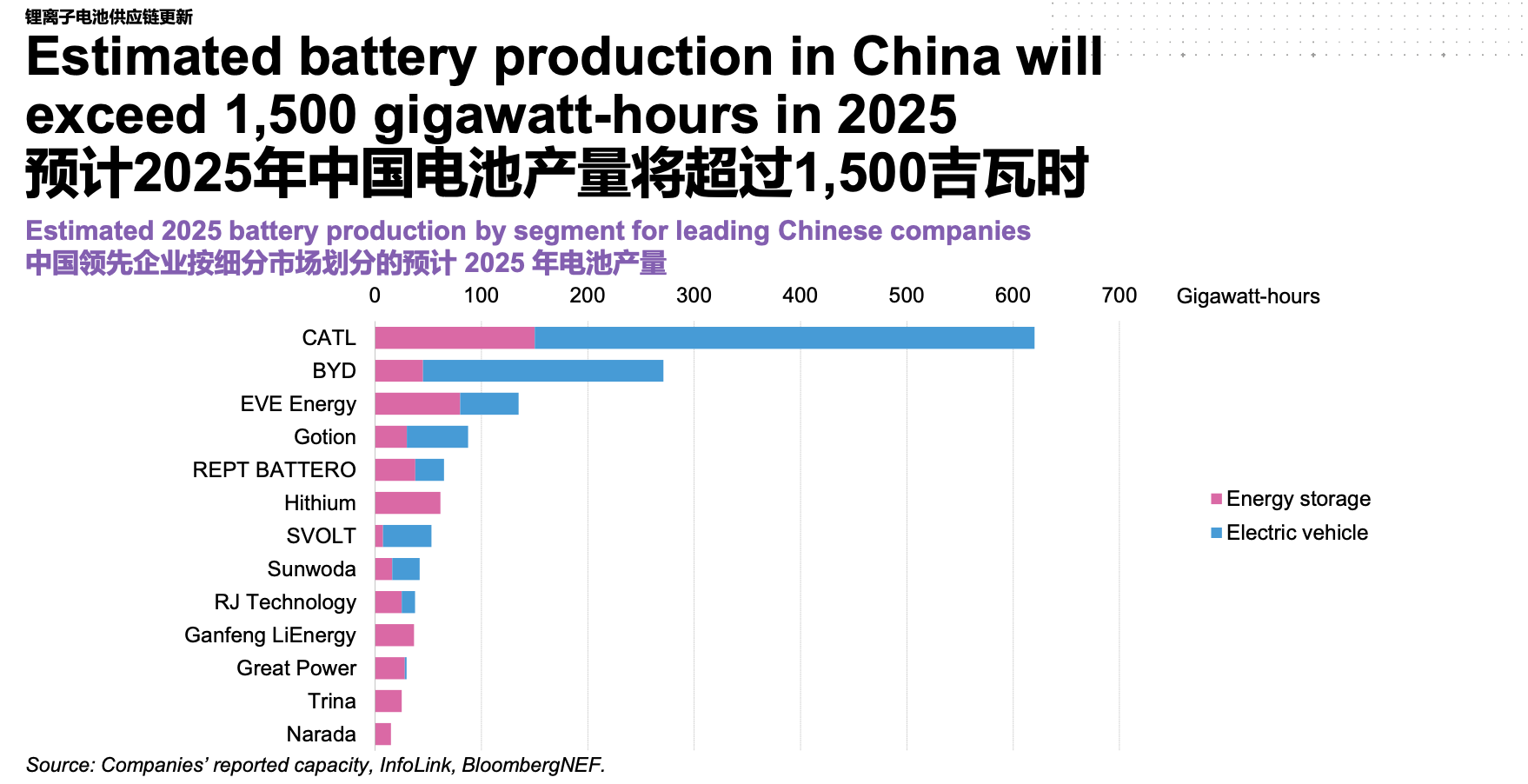

If the estimates hold, storage batteries will reach half the scale of power batteries this year. Total lithium-ion battery output is set to exceed 1,500 GWh, up about 28% year on year. Ministry of Industry and Information Technology data show that in 2024, China produced 260 GWh of storage-grade lithium batteries and 826 GWh of power batteries—roughly a 1:3 ratio.

BloombergNEF projects that Contemporary Amperex Technology Co. Ltd. (CATL) will produce more than 600 GWh of batteries this year, BYD nearly 300 GWh, and EVE Energy over 100 GWh.

As wind and solar accelerate their share in China's power mix, demand for storage has climbed accordingly. Around 2020, before the sector's breakout, storage output was only one-tenth that of power batteries; this year it is set to reach roughly half the level of power batteries. In recent months, storage battery expansion has even outpaced the power-battery sector.

Major construction projects underline the momentum. HiTHIUM has broken ground on the second phase of its Chongqing facility, with a total investment of 13 billion yuan to build 56 GWh of next-generation storage cells and 22 GWh of modules. PylonTech has signed a 2 GWh project in Hefei, while Envision Energy has begun work on a 40 GWh storage "super factory" in Yichang, slated to start production in 2026.

Shi expects the ratio of storage to power batteries to move toward 1:1 if the sector maintains its current growth trajectory.

On the power-battery side, Chinese firms are not the sole global suppliers, as Korean and Japanese manufacturers continue to serve markets that favor high-energy-density nickel-rich chemistries. Overall, Shi said, the power-battery sector remains relatively balanced in supply and demand.

Storage batteries, by contrast, are in a phase of rapid expansion, creating short-term mismatches between production and installed capacity. Much of today's production is meeting both current projects and expected future installations, she noted. Some storage-cell applications—including backup power and mobile systems—are also not fully reflected in installation statistics.

BloombergNEF estimates global new storage installations will reach a record 240 GWh this year, with strong growth expected in the years ahead. In China, new installations are projected to reach 130.4 GWh in 2025, up 22%, and could rise more than 25% next year.

Overseas demand has risen sharply. According to CCTV Finance, Chinese storage companies secured 163 GWh of new overseas orders in the first half of the year, up 246% year on year. Industry leaders are benefiting: Sungrow reported a 70% jump in storage shipments in the first three quarters, with overseas sales rising to 83% of its total.

Despite the boom, the consolidation once expected in the supply chain has not materialized. Shi said smaller players continue to win new orders, eroding the market share of top manufacturers. Utilization rates have improved: after the government urged the sector to avoid "irrational expansion," leading firms are now operating near full capacity.

China's revised Lithium-Ion Battery Industry Standards require companies to have produced at least 50% of their installed capacity in the previous year to qualify under the norms—a move designed to curb low-efficiency expansion. BloombergNEF data show industrywide utilization rates have rebounded to around 50%, with further improvement expected by year-end.

LFP battery prices and margins are recovering, supported by earlier orders that allow cell makers to pass upstream material cost increases to system integrators.

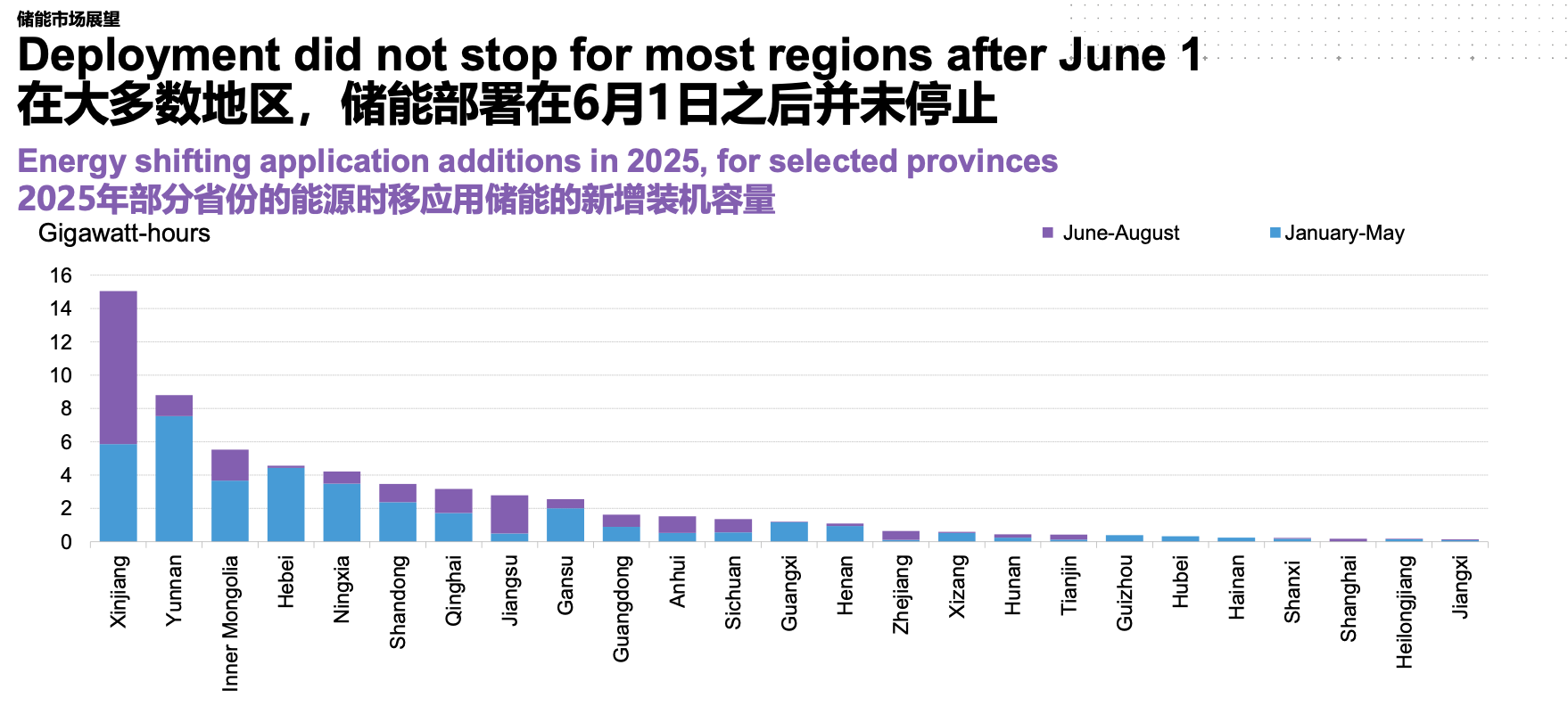

Although China removed mandatory storage-capacity requirements for new projects this year, Shi noted that underlying demand has not slowed. From June to August, provinces including Xinjiang, Jiangsu, Inner Mongolia and Qinghai continued to add substantial storage capacity.

China's storage market is steadily shifting from policy-led growth to market-driven expansion. "New policies are accelerating power-market reforms, turning what used to be theoretical benefits into quantifiable revenue streams," Shi said. But she cautioned that short-term returns may fall short of expectations, and further transitional policies may be needed to support long-term development.