On October 18, Shanghai Waigaoqiao Shipbuilding Co., Ltd (SWS) launched the construction of the first domestically built mega luxury cruise ship, which is scheduled to be delivered in the second half of 2023.

Rendering of a domestically built cruise ship. Photo credit: SWS

By ZHUANG Jian, XU Ning, CHU Yanmo

In a few years, will China surpass the U.S. to become the world’s largest cruise market?

Speakers enthusiastically discussed this very topic at the interactive session of a high-end tourism industry forum in early October, taking place at the Marriott Delta Hotel in Baoshan District, Shanghai.

Colin Au, the President of Genting Group, was the first to give an answer.

“It will take three decades,” he said.

According to Au’s estimate, the Chinese cruise market is growing at 10 percent each year, and the growth rate of the U.S. market remains steady at 4 percent. With the current five-fold gap, China will

Pierfrancesco Vago, executive chairman of the board of the Mediterranean Shipping Cruises Group (MSC Group), believes that China will surpass the United States in 2030 due to its larger population.

When the host put the same question to

This may sound like an effort to ingratiate the cruise industry its Chinese hosts, but the strategic investments international cruise giants are making in the Chinese market are concrete and lasting.

In the next two years, all three top cruise companies plan to deploy their newly built super-tonnage luxury cruise ships to China.

In 2020, the MSC Group will send the 172,000t

In 2021, Genting Group’s “Global Dream” will also dock in Wusong Cruise Port. It has a GRT of 225,282t. In the same year, the fifth Oasis-class ship of the Royal Caribbean will also sail to Shanghai. This ship will bring the capacity to another level, with a gross tonnage of close to 230,000t.

The arrival of

Wusong Cruise Port has been in operation for a mere eight years, but it has quickly become the number one cruise port in Asia and the fourth in the world. In the past few years, more than half of China’s cruising tourists embarked on their journeys from this port.

Wusong may be young, but it’s already become a witness to the rapid growth of the Chinese cruise market.

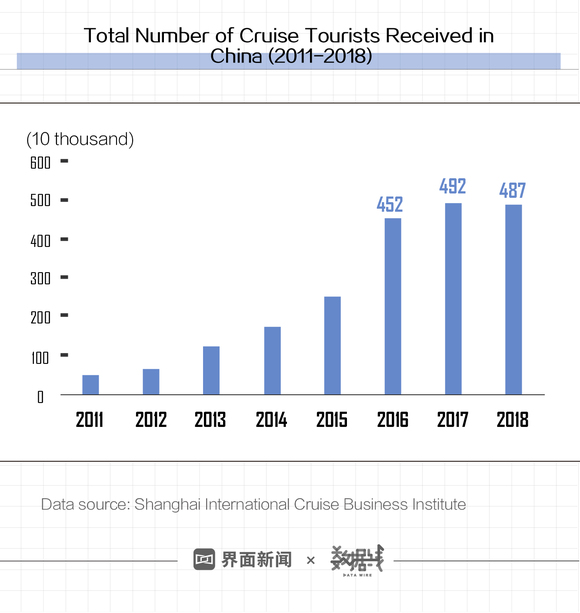

Last year, the number of cruise passengers in China reached 4.87 million. That’s ten times what it was in 2011. Although the growth rate of the Chinese cruise market has slowed in the past two years, no one doubts its potential for continued growth.

However, in this prosperous marketplace, there is little domestic capital.

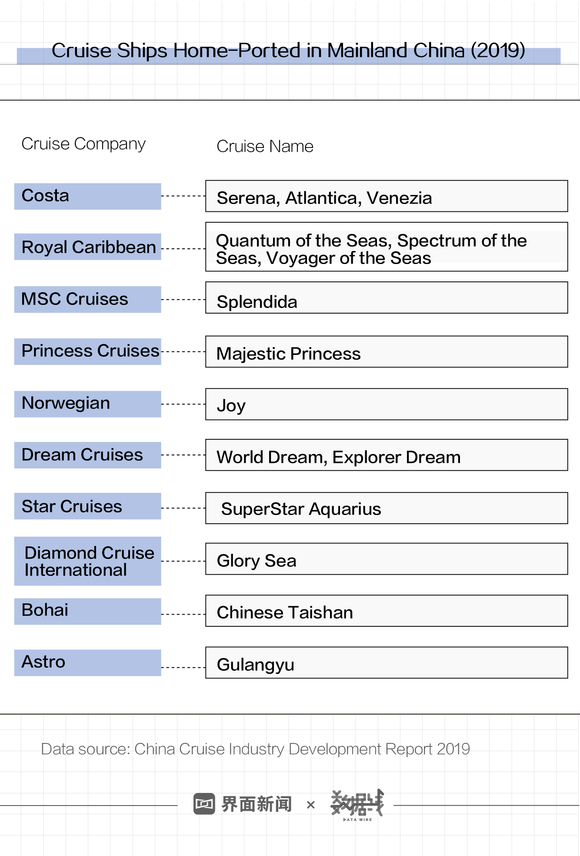

Most of the luxury ships cruising on the Chinese coast

Although China has long been the world’s largest shipbuilding country, mega ships

A handful of Chinese endeavors are trying to change that.

Shanghai Waigaoqiao Shipbuilding Co., Ltd (SWS)

On October 18, SWS officially launched the construction of the first domestically built mega luxury cruise ship. The 135,000t vessel

Taking its maiden voyage into the arena of

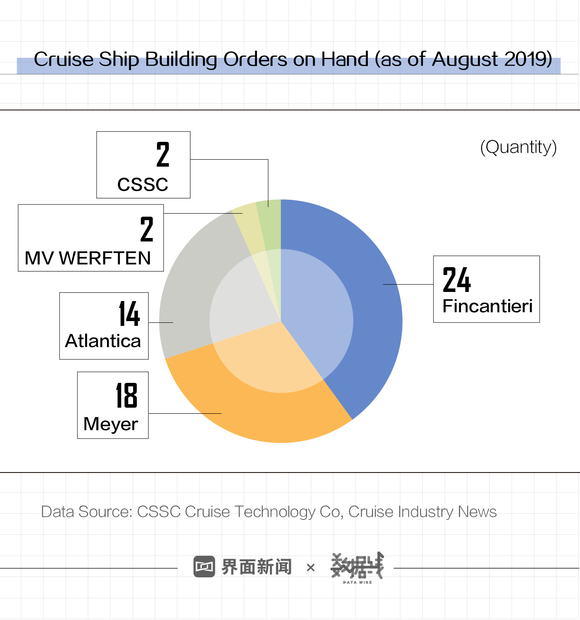

At the beginning of this project in 2012, CSSC started selecting partners and finally narrowed it down to two companies: the Italian Fincantieri Group (Fincantieri) and the American Carnival Corporation & PLC (the Carnival). The former is the world’s largest cruise shipbuilding company, while the latter is the world’s largest cruise operator.

It took

WANG

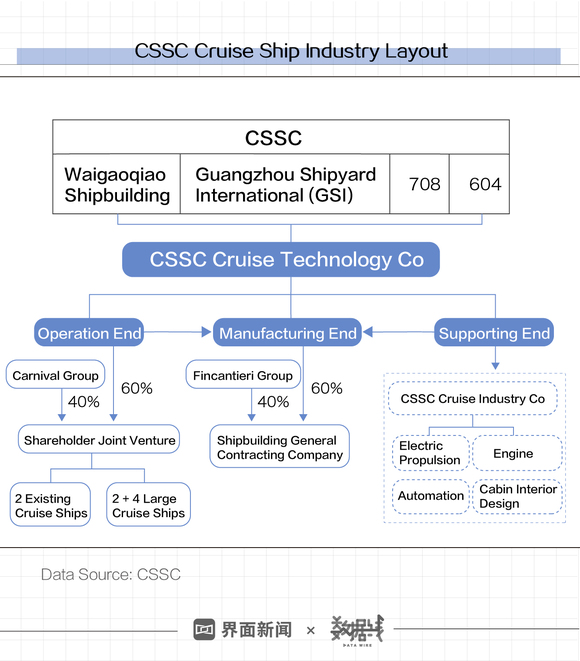

CSSC Cruise, as the only platform enterprise of CSSC’s cruise arm, is the primary responsible party and undertakes cruise ship research and development, cruise operation and supply chain construction. As the Chinese shareholder, it has established joint ventures with Carnival and Fincantieri, respectively.

CSSC Carnival Cruises Co., Ltd. (CSSC Carnival) is the operator of the first domestic luxury cruise ship; CSSC Fincantieri Cruise Industry Development Co., Ltd. (CSSC intention) is responsible for the design of the cruise ship.

According to the tripartite agreement, the first domestically built luxury cruise ship will

While the Italian company takes charge of conceptual design, CSSC

Such an arrangement has considerably reduced the challenge of building a luxury cruise ship, but the teams still face a lot of pressure to deliver the vessel as planned in four years’ time.

LNG (liquefied natural gas) ships, aircraft carriers and luxury cruise ships

Building a cruise ship entails putting together over 25 million parts.

Luxury cruise ships contain

FAN Qiang, VP of China Classification Society (CCS), said that it is still difficult to provide high-quality products in line with the construction of luxury cruise ships in China. Insufficient capacity is an obvious drawback and needs to

The Japanese have also faced this challenge. This has caused a failure to construct a cruise ship in Japan. The lack of a local supply chain has led to a serious delay in delivery and a sharp rise in costs.

SUN Changqing, Chief accountant of CSSC Cruise, also warned of the series of time management and logistical problems which may occur when sourcing heavily from overseas. These problems may prevent timely delivery of the ship and require the utmost attention throughout the designing and construction processes.

To make up for these shortcomings, CSSC will consider trying to relying on the capacity and resources of domestic partners,

An important development in this respect is the cooperation between

At present, the construction of such a supporting supply system is still in its infancy. Building a luxury cruise ship usually depends on close strategic partnerships with hundreds of suppliers.

For overseas shipyards with a mature supply chain and expertise in cruise construction technology, it takes about three years to deliver a cruise ship. Important milestones of this process include block construction, keel-laying, float out, sea trials, handover, and so on.

CSSC, which is to build its first mega luxury cruise from scratch, planned for a four-year project. Wang

The two cruise ships

If the “2+4 Plan”

At present, the two major brands of Carnival: Costa and Princess Cruises have deployed fleets in China.

In September, a joint venture called Astro Ocean Cruise launched its first voyage from Xiamen, its home port.

Astro Ocean Cruise bought a 69,000-ton cruise ship a year ago and renamed it “Gulangyu” after the renovation. As a result, the number of cruise ships operated by domestic cruise companies has increased to three.

This is obviously just the beginning.

The China Merchants Group also proposed similar goals. The global Fortune 500 state-owned enterprise is also venturing to establish a domestic cruise fleet.

At the beginning of this year, China Merchants Group signed an agreement to build four 37,000t cruise ships in batches, each costing 2 billion yuan (around 281 million USD).

According to YE Xinliang, deputy director of Shanghai International Cruise Business Institute, the domestic luxury cruise industry is in the incubation period and needs a lot of investment. Only state-owned enterprises with sufficient funding

“

Arnold Donald, the Carnival’s CEO, also attended the cruise industry forum mentioned at the beginning of this article.

When asked for his opinion on when China will become the world’s largest cruise tourism market, Donald said the date would depend on the number of ships deployed in the Chinese market, and he believed it would be within 20 years.