Fanatics Collectibles expects China to emerge as the leading collectibles market in Asia.

Stephon Marbury shows cards at a fan event. Photo courtesy of the interviewee

by WU Bingcong

TOPPS, the trading-card brand owned by Fanatics Collectibles, is stepping up its push into China after regaining the exclusive global NBA license, betting that the world's second-largest consumer market can fuel the next stage of growth in a fast-expanding collectibles industry. The company is rolling out lower-priced products, expanding online distribution and launching crossover collaborations to turn what has long been a niche hobby for wealthy collectors into a mainstream pastime.

The global sports trading-card market was valued at US$13.82 billion in 2019 and is projected to reach nearly US$100 billion by 2027, according to Verified Market Research. Growth has been driven by rising fan engagement, broader licensing deals and the investment appeal of rare cards, with secondary-market prices for some signature items climbing hundreds of times from their original issue levels. By contrast, China remains an early-stage market dominated by high-net-worth buyers, presenting both a challenge and a major opportunity for global brands looking for new customers.

GUAN Jian, a veteran NBA fan and former moderator of Baidu's sports-card forum, represents the current profile of China's core collectors. Over 12 years he has accumulated more than 100,000 cards valued at over RMB 1 million (about US$14 million). He once paid more than RMB 200,000 for a rare LeBron James card and tracks pricing across hundreds of WeChat groups to buy and sell on the secondary market. But he remains an outlier: most Chinese consumers have limited exposure to trading cards, and entry barriers remain high as many premium cards circulate only through niche auctions or private transactions.

TOPPS is trying to change that. After its NBA partnership took effect on October 1, the company released NBA Match Attax 2025—a China-exclusive, lower-priced series co-developed with local card company Kayou. Priced at RMB 10 to RMB 20 per pack, the line is designed to attract first-time buyers beyond major cities. The company has also introduced new formats including "promise cards," which grant fans social-media interactions with specific players when pulled from packs, part of its effort to build fresh engagement hooks for younger audiences.

The push comes as competition intensifies in global sports licensing. TOPPS's reclamation of the NBA rights from Panini resets the balance of power in one of the industry's most valuable categories. A broader rights portfolio allows TOPPS to release more diversified product lines, while Panini's legacy inventory continues to dominate segments of the secondary market. The rivalry is increasingly extending to design, athlete partnerships and regional strategies—areas where China is emerging as a critical battleground.

TOPPS until recently lacked a local team in China, but in 2025 the company began building a presence across distribution, marketing and offline events. It opened a Tmall flagship store in late September, and though the channel remains small, growth has been rapid. The brand has also expanded its social-media footprint since late 2024, accumulating more than 400,000 followers with localized content aimed at introducing card culture to new consumers. Offline pack-opening events featuring athletes such as former Beijing Ducks star Stephon Marbury have helped raise visibility.

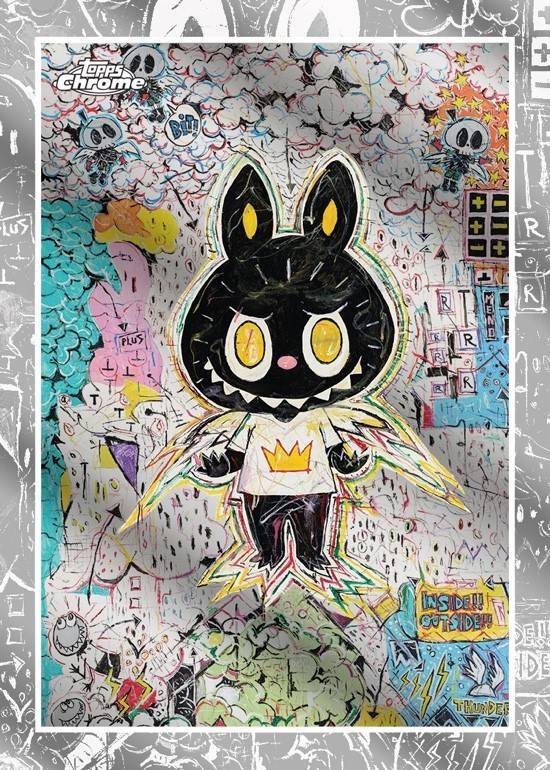

The company is also leaning into cross-industry collaborations to reach non-sports audiences. During this year's China Open tennis tournament, fans bought entire boxes to hunt for cards featuring Chinese players ZHENG Qinwen and WANG Xinyu, then queued for autographs after matches. A limited-edition Chrome series themed around LABUBU—a viral designer-toy IP—sold out quickly on both TOPPS's international website and its Tmall store, demonstrating the demand for products that bridge sports, collectibles and pop culture.

Collectors say China's market could grow rapidly if the category becomes more accessible. Some players, such as Jokić collector and parenting influencer "Ouba," view cards as both investment assets and family activities; others see them primarily as emotional connections to sports and athletes. The trend aligns with broader shifts in China's consumer landscape, where interest-based spending and IP-driven products continue to expand despite macroeconomic headwinds.

WANG Ying, Asia-Pacific president of Fanatics Collectibles, says China could become the most important collectibles market in the region. The country's large and increasingly sophisticated fan base for basketball, football and tennis gives the industry a foundation that companies can build on through local designs, lower-priced entries and diversified collaborations. "We want parents and kids to enjoy opening boxes together," she says.

Despite the optimism, TOPPS and its rivals still face challenges. China's secondary market remains fragmented, and the hobby is far from mainstream, with consumer awareness and participation still at an early stage. But with major licenses shifting and global competition intensifying, companies see China not just as a sales channel but as a potential growth engine for the next decade. As Guan puts it, the appeal of cards crosses generations: "People as young as a few years old or as old as eighty can enjoy them. There will be more players in China."