"The industry's core issue is simple: more units, less money."

Photo from Jiemian News

by JIANG Xi

China's industrial robot market is expanding rapidly, but manufacturers are struggling to turn rising shipments into earnings as a fierce price war erodes margins.

Industry revenue rose 29.5% in the first three quarters and output reached 595,000 units, surpassing the total for all of 2024, Song Xiaogang, secretary-general of the China Machinery Industry Federation, said at the 2025 China Robot Industry Development Conference on Nov.11. The International Federation of Robotics estimates that China installed 295,000 industrial robots last year, representing 54% of global demand.

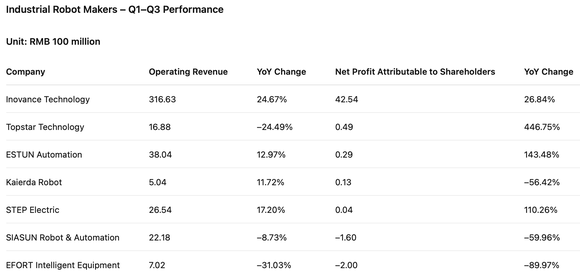

Strong volume growth has not translated into broader profit gains. A Jiemian News review of seven listed companies shows earnings increasingly depend on cost-cutting and investment income rather than core robot sales.

Inovance Technology reported record nine-month revenue and profit, up 24.67% and 26.84%, but said the improvement came mainly from slower growth in expenses and investment gains. Robotics accounted for less than 3% of its first-half revenue.

Topstar Technology posted a 446.75% jump in net profit despite a 24.49% drop in revenue, helped by lower financing costs after its convertible bond delisting. Its robot and automation business grew modestly but margins weakened.

ESTUN Automation and STEP Electric also delivered higher profits, but both attributed the gains to tighter expense control and fair-value investment income. ESTUN remained the top domestic supplier by shipment volumes, although its gross margin slipped.

Other players remain under pressure. SIASUN Robot & Automation and EFORT Intelligent Equipment both reported lower revenue and continued losses. Kaierda Robot increased sales but saw net profit slump 56.42%, reflecting persistent margin compression.

Executives say relentless price cutting is the main drag. SIASUN's filings show its industrial robot revenue fell 46% in the first half as prices continued to decline. EFORT said sector-wide discounting and lower prices for strategic customers pushed its robot revenue down 17.05%.

"The industry's core issue is simple: more units, less money," said ZHAO Yong, general manager of China Robot Network. "Prices are falling faster than costs, and the room to cut production expenses is limited."

GaoGong Robot Industry Research Institute (GGII), prices for SCARA robots — a fast pick-and-place arm widely used in electronics and auto assembly —have dropped to around 10,000 yuan per unit, roughly half last year's level. Six-axis 6-kg models, a common lightweight model on production lines, now sell just above 20,000 yuan (about US$1400), while some collaborative robots are priced below that threshold, deepening the squeeze.

Profitability could improve as robot adoption broadens and component costs fall, Zhao said, noting that manufacturers are also looking to lift revenue through more customized systems and after-sales services. Official data shows that Chinese industrial robots were deployed across 71 major industries and 241 sub-industries in 2024, up sharply from 2020.

For now, China's robot makers face a widening gap between fast-growing shipments and shrinking profit pools—a sign that scale alone is no longer enough to sustain earnings in an increasingly crowded market.