It is expected to give China and other major importers a stronger voice in setting global iron ore prices.

Simandou iron ore project. Photo from Winning International's official WeChat account.

by TIAN Heqi

Guinea's Simandou iron ore project has started shipments after 28 years of delays, a move set to reshape global supply and give China greater leverage in iron ore pricing.

A barge carrying 9,850 tons of ore departed Moribayah Port on Nov.11, according to Rio Tinto, one of the project’s key investors. Guinea's president attended the launch ceremony with executives from SMB-Winning Consortium (WCS), China Baowu Group, Aluminum Corporation of China (Chinalco) and Rio Tinto.

"This marks a historic moment for the global iron ore market," said WANG Guoqing, director of the Lange Steel Research Center, adding that the project will shift supply flows and enhance China's bargaining position in future price talks.

The deposit, stretching 110 kilometers across southeastern Guinea, holds an estimated 4 billion tons of high-grade ore and is regarded as the world's largest untapped iron resource. The project is divided into northern and southern blocks. Rio Tinto first secured exploration rights in 1997, but political instability and ownership disputes kept it idle for decades.

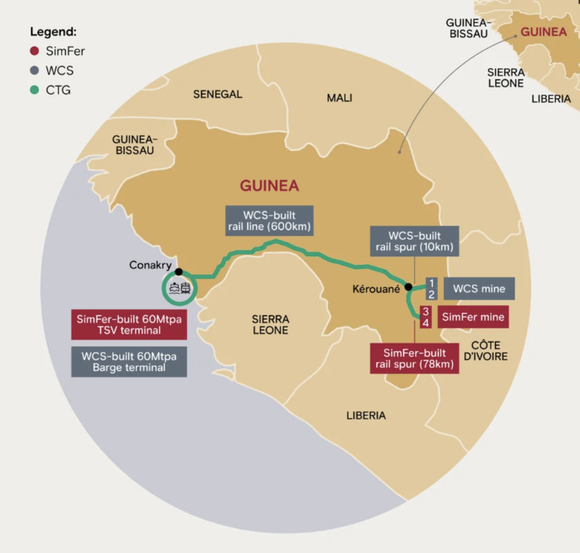

In 2019, WCS—a consortium of Winning International Group, Weiqiao Aluminum & Power, United Mining Suppliers International and Baowu Resources—took over the northern blocks in a US$14 billion deal. The southern blocks are operated by Simfer, a joint venture between Rio Tinto and Chalco Iron Ore Holdings, with the Government of Guinea holding a minority stake. Baowu participates indirectly through its 20% stake in Chalco Iron Ore Holdings.

Construction gained pace in 2024 after Rio Tinto approved a US$6.2 billion investment for port and railway infrastructure. The 600-kilometer Trans-Guinea Railway, connecting the mine to the Atlantic coast, was completed in July 2025 and is designed to handle more than 100 million tons of cargo annually.

At full capacity, Simandou is expected to produce 120 million tons a year—equivalent to about 10% of China's 2024 imports and 30% of Brazil's exports. Wang said the output could reduce China's dependence on suppliers such as BHP, Rio Tinto and Vale, while increasing its share of "equity ore," or overseas production controlled by Chinese firms.

China accounts for roughly 70% of global iron ore imports. Global seaborne imports reached 1.7 billion tons last year, with almost all the increase driven by Chinese demand, according to Kpler.

Consultancy Discovery Alert said the project could pressure high-cost miners in Australia and Brazil, with global seaborne supply projected to rise 8–9% by 2028. Rio Tinto CFO Peter Cunningham said in July the new output may force some producers to exit the market.

The ore's purity also gives Simandou a greener edge. Sidiki, a geology manager at Rio Tinto, said Simandou's ore is "special", — it contains about 65% iron, which is rare, and very low levels of phosphorus, silicon and sulfur, making it cleaner to process. The IMF estimates the project could boost Guinea's GDP by 26% by 2030, underscoring its economic and strategic importance.