In recent years, Starbucks has stumbled amid fierce local competition and a rapidly shifting market. For the new venture, the question now is how Starbucks China should move forward.

Photo from Jiemian News

by LI Ye

After 26 years in China, Starbucks finds itself at a new beginning.

On November 4, 2025, Boyu Capital acquired about 60% of Starbucks China's equity and franchise rights for US$4 billion, forming a joint venture to run its mainland business. The deal, valuing Starbucks China above US$13 billion, capped a year-long bidding race among 30-plus investors — from Hillhouse and Primavera to Sequoia China and Tencent — making it one of the most closely watched consumer acquisitions of the year.

Insiders say Starbucks posed one simple question to every bidder: "How would you grow Starbucks China?"

Now Boyu must answer it — together with the Seattle giant itself.

Starbucks once defined China's coffee awakening.

When it opened its first store in 1999, tea dominated daily life. The American chain introduced "the third place" — a comfortable, social space between home and work — and rode two decades of urban middle-class expansion. By 2019, it controlled more than 40% of China's branded coffee market.

Its success was once so coveted that shopping-mall landlords offered flexible rent deals or even "reverse guarantees," buying unsold cups to keep stores afloat. But in a hyper-competitive consumer market, advantages never last.

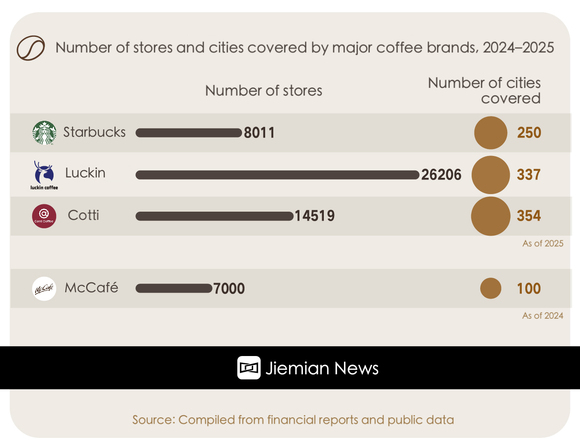

The real shock came after 2019. Luckin Coffee, founded the same year, raced ahead with tiny pick-up stores, mobile ordering, and heavy discounting. By 2023 Luckin's outlets had surpassed Starbucks', marking a psychological turning point.

When Starbucks' China revenue plunged by US$600 million in 2022, executives blamed the pandemic. But Luckin's delivery-first, lower-cost model kept expanding.

Today, Starbucks still has over 8,000 stores — but faces shrinking queues and a younger generation that sees a 30-yuan latte as optional, not aspirational. In Shanghai and Guangzhou, dozens of once-iconic stores have closed. "Some landlords now reserve good locations for brands that attract younger crowds," said ZHANG Jiefeng, who managed store expansion for six years. "Starbucks remains reliable, but opening new stores is far tougher."

ZHOU Changqing, chairman of Zhongshang Consulting and head of the brand committee at the Shanghai Council of Shopping Centers, told Jiemian News that Starbucks' store density in some commercial districts is already sufficient, meaning it no longer needs so many locations.

Attempts to push into smaller cities have also faltered. While county-level stores enjoy lower rent, many quickly fall to break-even. "After the honeymoon, business drops fast," Zhang said. Consumers there prefer 10-yuan coffees; Starbucks' "third place" concept rarely fits.

During the bidding, multiple investors urged Starbucks China to learn from local rivals — open smaller, cheaper outlets and adjust prices. Starbucks' leadership resisted. Former CEO Belinda Wong had previously rejected a low-cost sub-brand, fearing it would erode the premium image.

Yet to double its store count to 20,000 — a goal announced with Boyu — small stores seem unavoidable.

Large "third space" stores in prime districts now carry enormous fixed costs. In Shanghai's core malls, average rent reached 46 yuan per square meter per day in 2024. A flagship store of 500–600 square meters can cost up to 8 million yuan a year.

One solution: shut high-cost flagships, keep a few for branding, and roll out compact formats elsewhere. But Starbucks has tried this before. In 2019 it launched "Starbucks Now," or Fei Kuai, a 20-square-meter takeaway model. Internally, the trial was deemed "unprofitable."

"Labor and ingredients cost the same, while traffic is lower," Zhang said. The menu stayed full-size, blunting cost savings.

To avoid repeating that mistake, Starbucks and Boyu must rebuild a store model from the ground up — with localized menus and tighter cost control — not just smaller floorspace.

Starbucks' slow product cycle has also hurt it in the era of viral beverages.

"Honestly, no drink stands out these two years — except the classic Toffee Nut Latte at Christmas," said SONG Qing, a barista in Yunnan. In 2024 the chain released 78 new products, yet few sparked online buzz. Luckin introduced 119 new drinks and kept feeds scrolling.

Store staff are pressured to upsell, sometimes to the point of customer fatigue. Meanwhile, Starbucks' innovation process — local idea, regional pilot, headquarters review, nationwide rollout — is safe but slow. One industry R&D head told Jiemian News that multinationals often let China teams tweak formats and channels but not formulas or ingredients. A coffee industry insider told Jiemian News that Luckin divides its R&D into A and B teams that compete internally before launch, and its research now extends to developing industrial-grade ingredients rather than finished drinks — while Starbucks remains focused on sourcing ingredients.

There is, however, precedent for change. McDonald's China transformed after its 2017 sale to a CITIC-led consortium — a structure similar to Starbucks' new joint venture.

"Half our board are Chinese or long-time China residents," McDonald's China CEO Zhang Jiayin once told Jiemian News. "This makes decision-making faster and more local."

For Starbucks, Boyu's entry could open the same door: a locally driven board that moves faster and experiments freely with Chinese tastes and digital campaigns.

Founder Howard Schultz has long feared that mobile ordering would "dilute the Starbucks experience." Yet in China, digital integration is non-negotiable. Boyu's track record with Alibaba and Ant Group offers ready synergies in payment, loyalty and user data — areas where Starbucks still lags behind Luckin and Manner.

Operationally, Boyu can also help re-map Starbucks' real-estate footprint. It holds stakes in property firms like Vanke Services and Jinke, giving access to residential and office locations for new-format stores. In logistics and supply chain management, its consumer portfolio — from duty-free retailer Sunrise to bottler CR Beverages — could create shared efficiencies.

Boyu has proven adept at nurturing potential assets, having invested early in Alibaba, managed the growth of Sunrise Duty Free, and taken part in the IPOs of Mixue, Haitian Flavouring and Food, and CR Beverages. Its investment portfolio spans retail, real estate, technology, finance and healthcare, reflecting deep knowledge of China's consumer ecosystem.

Even frontline staff hope for change. "Our inventory still relies on manual checks each week," Song said. "I hope digital tools can ease the load."

Starbucks no longer holds a majority stake in its China business — and that may be its biggest liberation.

"Without control, it must share decisions," one consumer investor told Jiemian News. "The brand and locations remain its core assets, but the new shareholder will push for local operations and a second growth curve."

In fiscal 2025, Starbucks China returned to growth with revenue up 5% to US$3.11 billion. Same-store sales and traffic rose for two consecutive quarters, and its membership base hit 25.5 million. Margins remain in double digits despite a price war among delivery apps — proof that the underlying business is still healthy.

The new joint venture will keep its headquarters in Shanghai and pledges to accelerate drink innovation, digital operations and market expansion beyond major cities. But its deeper task lies in translating trust into execution — and transforming a global coffee brand that was slow to adapt into one ready to compete in China's reshaped coffee-and-tea landscape, where agility, local management and a renewed sense of premium value will define its comeback.

For Starbucks, after a decade of slower growth and mounting competition, that might be exactly what it needs to start anew.