Large shipyards posted 398.8 billion yuan in revenue, up 20.8%, while profits jumped 72.6% to 38.7 billion yuan in the first half of 2025.

Photo from Jiemian News

by JIANG Xi

China's shipbuilding industry extended its lead in the first half of 2025 even as global orders slowed. Data from the China Association of the National Shipbuilding Industry (CANSI), the country's main trade body, showed large shipyards generated 398.8 billion yuan (about US$56 billion) in revenue, up 20.8%, while profits jumped 72.6% to 38.7 billion yuan (about US$5.5 billion). Exports climbed 18.6% to about US$24.5 billion, with margins reaching a record 9.7%.

Speaking at Marintec China 2005 press conference on Sept.17, CANSI deputy secretary-general TAN Naifen said higher efficiency and firm ship prices boosted profitability, while steel costs remained broadly stable.

China accounted for about two-thirds of new orders and more than half of global deliveries in the first half. Shipyards delivered 24.1 million dwt, slightly below last year, while new contracts fell nearly 20%. Even so, the orderbook expanded by more than a third to 234.5 million dwt, with exports close to 90%. Green vessels added momentum, giving China nearly 70% of global low-carbon orders.

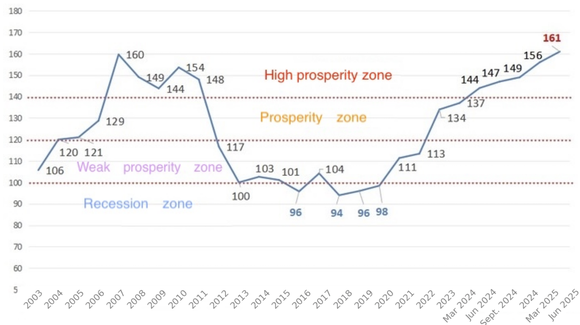

By end-June, CANSI data showed China held 51.7% of global deliveries, 68.3% of new orders and 64.3% of the orderbook - the three core indicators of shipbuilding scale - keeping it in the lead worldwide. The association's prosperity index climbed to a record 161, far above the 140-boom threshold, underscoring the sector's resilience.

Meanwhile, global momentum cooled. UK-based Clarksons Research reported new orders fell 54%, and the Clarkson Shipping Index - a key freight and market gauge - slipped 5%, or 31% excluding container ships, to below its 10-year average.

While global orders slowed in the first half, shipbuilding remains in an upcycle that began in 2021, driven by replacement demand and the sector's green transition. XING Wenhua, chairman of the China International Maritime Conference & Exhibition, said the cycle is now entering a crucial stage, with geopolitics, decarbonization and limited capacity weighing on sentiment.

Tan forecast China will deliver about 51 million dwt this year, with new orders easing slightly but orderbooks holding above 230 million dwt.