China's listed insurers posted steady growth in H1 2025, with participating insurance products gaining traction and bancassurance driving new business value.

Photo from Jiemian News

by FENG Lijun

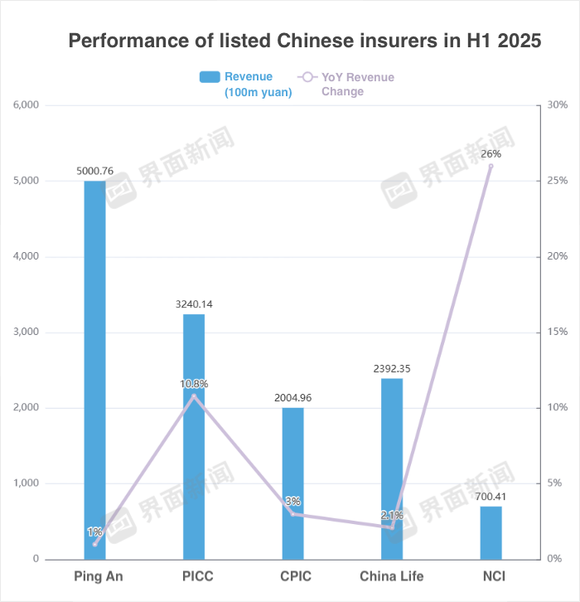

China's top listed insurers reported steady results in the first half of the year, with revenues rising across the board but diverging growth paths. Among the five major A-share players—Ping An, PICC, China Pacific (CPIC), China Life and New China Life (NCI)—New China Life outpaced peers, posting revenue growth of 26 per cent to about 70 billion yuan.

Ping An retained the industry's top spot by revenue at 500.1 billion yuan, though growth slowed to just 1 per cent. PICC's revenue rose more than 10 per cent to 324 billion yuan.

In terms of profit, all but Ping An recorded gains. NCI's net profit attributable to shareholders rose by more than 33 per cent, while Ping An fell 8.8 per cent, dragged by market volatility and one-off accounting effects from its health unit.

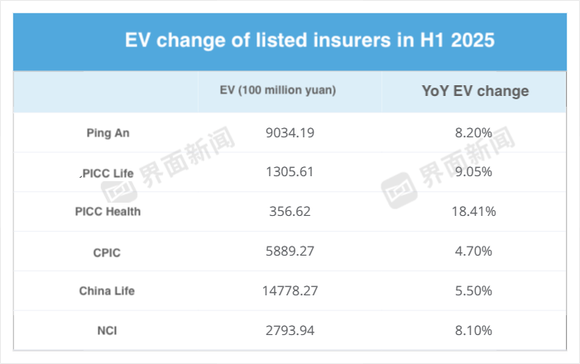

Embedded value, a key gauge of long-term profitability for life insurers, also climbed across the sector. Ping An and NCI rose 8.2 per cent and 8.1 per cent respectively, while PICC Life and PICC Health advanced 9.05 per cent and 18.41 per cent. Soochow Securities' analysis attributed the momentum to robust new business value growth and stronger investment returns.

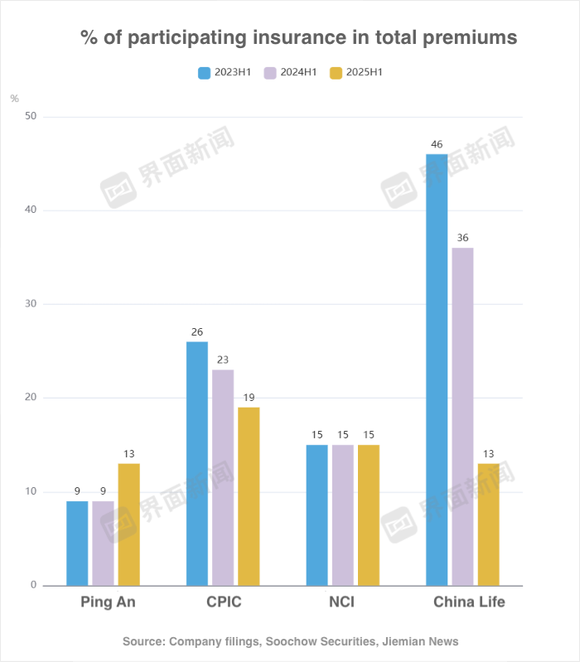

Participating insurance products, which insurers have been pushing to lower rigid liability costs, showed signs of traction. Ping An's participating insurance premiums surged 41 per cent, accounting for 12.8 per cent of its life and health business, up from under 10 per cent a year earlier.

CPIC's new first-year regular premium business from participating insurance products surged, with such products accounting for 42.5 per cent of all new regular premium policies. China Life and NCI also reported sharp jumps.

Bancassurance emerged as the star performer. Ping An's bancassurance new business value leapt 169 per cent, while PICC more than doubled and CPIC posted gains of 107.7 per cent and 156 per cent respectively. China Life's bancassurance first-year premiums more than doubled, and NCI reported a 150 per cent surge.

In contrast, traditional agent channels remained under pressure, with Ping An and CPIC both seeing declines. Only NCI achieved strong growth in individual agent-sold policies, up 70.8 per cent.

On the property insurance side, tighter expense controls helped lower combined ratios across the big three—Ping An P&C, PICC P&C and CPIC P&C—bringing them firmly below the 100 per cent breakeven threshold.

Auto insurance was the main driver, with Ping An and PICC cutting combined ratios to 95.5 and 94.2 per cent respectively.

Non-auto lines were mixed: Ping An's health insurance ratio improved significantly, while agriculture insurance worsened. PICC's liability business remained loss-making but narrowed its deficit, and CPIC's health insurance swung to profit despite shrinking premium income.