Six listed Chinese tea chains posted combined first-half profits exceeding 5 billion yuan, but industry consolidation is intensifying as weaker players struggle.

Photo from Jiemian News

by JIANG Yiman

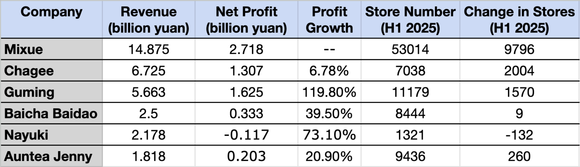

Six publicly traded tea chains — part of what is known in China as the "new tea" sector of freshly made milk and fruit-based drinks — reported more than 30 billion yuan (US$4.1 billion) in combined revenue for the first half of 2025.

Mixue Group remained the clear leader, while Guming delivered the fastest profit growth. Chagee, Baicha Baidao (which operates under the brand name Chabaidao) and Auntea Jenny also stayed profitable, but Nayuki Holdings (which operates under the brand name Naixue) continued to post losses, though its deficit narrowed sharply.

Aggressive store expansion underscored the diverging strategies. Mixue added nearly 10,000 outlets in six months, taking its network past 53,000 globally. Guming opened more than 1,500 stores to surpass the 10,000 mark, while Auntea Jenny, Chabaidao and Chagee each operate between 7,000 and 9,000. Naixue, by contrast, closed 132 shops, reducing both its directly operated and franchised network.

Analysts said the sector is shifting to a zero-sum game as the market nears saturation. iiMedia Research estimated China's tea drinks market reached 354.7 billion yuan (US$48.9 billion) in 2024, up just 6.4 per cent year on year, far below past double-digit growth. Industry tracker Canyan Data said that as of mid-July there were 426,000 tea shops nationwide. Despite 118,000 new openings in the past year, the total still shrank by 39,000.

Goldman Sachs recently raised its earnings forecasts for Mixue and Guming, citing stronger-than-expected support from food delivery subsidies. But it warned that once subsidies end in 2026, sales growth may fade, potentially accelerating consolidation in favour of chains with scale and supply-chain advantages.