After two years of restructuring and recovery, the airline posted impressive financial results in March 2025.

by Xue Bingbing

A gleaming Douglas aircraft stands at the entrance of Cathay Pacific’s headquarters in Hong Kong, a tribute to the airline’s storied past. Once at the forefront of global aviation, Cathay faced its most daunting crisis during COVID-19. Yet, after two years of restructuring and recovery, it posted impressive financial results in March 2025.

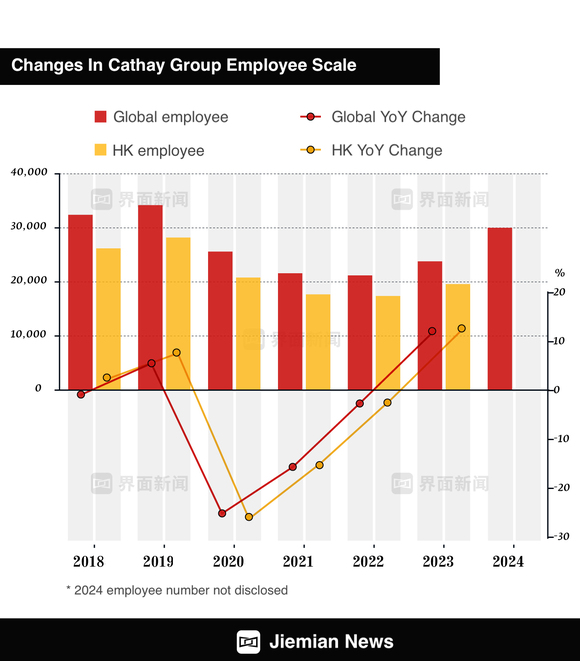

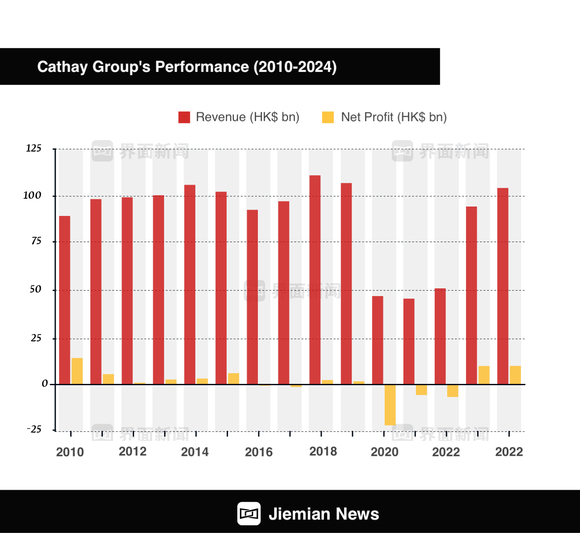

From 2020 to 2022, Cathay Pacific endured a near-total shutdown. Passenger numbers plummeted from 100,000 to just 302 per day, pushing losses to HK$2 billion monthly. With survival at stake, the airline shut Dragonair, cut 8,500 jobs, and launched a HK$39 billion recapitalization plan.

Recovery began in late 2022 as travel resumed. In January 2023, Ronald Lam became CEO, vowing not just to restore Cathay but to make it stronger. However, the "blanket incident" in May 2023, where crew members were accused of discrimination, damaged its reputation.

By the end of 2024, Cathay completed its restructuring. In January 2025, flight capacity returned to pre-pandemic levels, and profits neared HK$10 billion for the second consecutive year, proving internal reforms were driving long-term success.

Cathay, Hong Kong’s largest airline, flew to 119 destinations with 239 aircraft at its peak. Pandemic restrictions slashed its capacity to below 10%, forcing 85 planes into long-term storage in Australia.

As travel resumed, Cathay worked to restore flights. Returning grounded aircraft took up to six months per plane, with full reactivation completed by mid-2024. Fleet expansion restarted with a HK$100 billion investment, including orders for 30 Airbus A330neos.

Manpower shortages posed a greater challenge. After years of layoffs, Cathay launched aggressive hiring campaigns, recruiting thousands of pilots and crew, including its first-ever mainland China-based hires. In 2024, it hired 7,000 employees, restoring its workforce above 30,000.

Cathay, listed on the Hong Kong Stock Exchange since 1986, faced steep losses from 2020 to 2022, totaling HK$33.7 billion. A swift recovery followed in 2023, with HK$10 billion in profit, driven by strong international demand and pricing power. While 2024 saw lower margins, revenue still surpassed HK$100 billion.

Cathay paid HK$19.7 billion in dividends on government-held preferred shares in 2023 and repurchased 50% of those shares. The HK$7.8 billion transitional loan was never drawn. In July 2024, Cathay redeemed the remaining 50% of the preferred shares, amounting to HK$9.8 billion, cementing its financial stability.

The "blanket incident" prompted Cathay to overhaul its service culture. The airline expanded Mandarin-speaking crew, improved in-flight menus, added Chinese entertainment, and launched a cultural training program for staff.

Greater China has become central to Cathay’s strategy, contributing nearly 60% of revenue. The airline now operates 290 weekly flights to 20 mainland cities, with new routes like Hong Kong-Urumqi launching in April 2025.

Cathay appointed Arnold Cheng as its China Managing Director, based in Shenzhen, underscoring the Greater Bay Area’s importance. However, it faces rising competition from mainland carriers, budget airlines, and geopolitical uncertainties.

Despite challenges, Cathay Pacific’s revival is a testament to its resilience, strategic reforms, and renewed focus on mainland China. Now, the airline looks to sustain its momentum and navigate a rapidly evolving aviation landscape.