Chery entered overseas markets earlier than most Chinese automakers, a move once seen as risky. Now, global expansion is a battleground for China’s top auto companies.

Photo by Kuang Da

by Yang Shihan, Zhou Shuqi

Every morning at 5:30 a.m., Zhang Guibing, General Manager of Chery International, arrives at headquarters, starting his day with a walk where employees often seek his input or signature. As the actual work hours begin, back-to-back meetings keep him busy until late at night.

“There’s always a queue for his signature. He reviews every document meticulously, even minor ones like temporary overseas assignments,” a Chery International staff member told Jiemian News. His hands-on approach ensures no detail is overlooked, keeping his team sharp.

This level of dedication permeates Chery’s culture. Chairman Yin Tongyue has openly praised employees for their relentless work ethic. At night, the headquarters remains brightly lit, with many employees working past 9 p.m. The typical workday exceeds 12 hours, and most employees do not have two-day weekends.

For those in Chery International’s marketing department, the workload is even more demanding. By day, they handle domestic operations; by night, they liaise with distributors and regional market teams across different time zones. Due to cultural differences and market demands, many go years without taking extended leave.

According to the latest figures from the China Association of Automobile Manufacturers, Chery exported 1.14 million vehicles in 2024, a 23.7 percent year-on-year increase. This achievement allowed Chery to surpass SAIC Motor by over 200,000 units, breaking SAIC’s seven-year streak as China’s top auto exporter.

To visualize Chery’s scale: imagine an empty football field continuously being filled with cars until all gaps are occupied. Now, stack 1,600 of those fields on top of each other—that’s how many vehicles Chery shipped overseas last year.

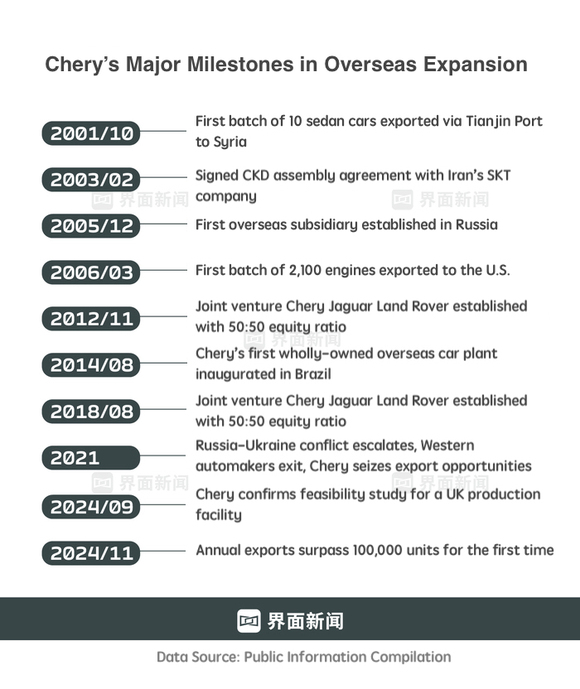

In November 2024, Chery surpassed the one-million-unit export mark in a single year, setting a record for Chinese automakers. It took the company 23 years to reach this milestone—a pace comparable to Toyota’s global expansion and slightly ahead of Hyundai’s.

Chery’s rapid growth aligns with the broader trend of Chinese auto exports. In 2021, China’s auto exports surged past 2 million units for the first time. By 2023, China had overtaken Japan as the world’s largest auto exporter, shipping 4.91 million vehicles. In 2024, the figure climbed to 5.86 million, nearly a 20 percent increase.

Auto analyst Mei Songlin describes Chery’s success as a turning point for the industry. “This proves that Chinese automakers have truly gone global,” he said.

In the Middle East, Chery has become synonymous with high quality. Gao Lei, Marketing Director at Shiji Motors, noted that consumers in the region now actively seek out Chinese cars. “Customers approach us with detailed specs of their preferred Chinese models and directly request purchases,” he said.

Beyond the Middle East, Chery is also making inroads into South Asia. Bangladesh, with its fast-growing economy and expanding middle class, has become a key target market.

Lincoln, a veteran Bangladeshi automotive journalist, said that Chery has relocated its showroom to a bustling commercial district, now positioned alongside Nissan, Mitsubishi, Mercedes-Benz, and BMW. Seventeen years ago, Chery’s first dealership was in a quieter residential area, mainly selling compact Chery QQ models. Today, the company’s bestsellers in Bangladesh are three SUV models, reflecting its growing confidence in competing with global brands.

Chery’s strategic approach to overseas expansion has been shaped by geopolitical shifts, advancements in smart vehicle technology, and an early commitment to exports. Unlike many Chinese automakers that prioritized domestic markets before expanding abroad, Chery viewed international markets as an integral part of its long-term strategy from the outset.

Founded in 1997, Chery launched its first car, the Fengyun, two years later. When Fengyun officially debuted in 2001, it exceeded sales expectations—SAIC, Chery’s early partner, had set a target of 5,000 units, but Chery sold 28,000 instead.

That same year, at the Beijing Auto Show, a Syrian businessman took an interest in the Fengyun model and wanted to import 200 units. He tracked down Yin in Shanghai and eventually signed a deal alongside the road, marking Chery’s entry into international markets.

While other Chinese automakers waited over a decade before exporting, Chery began shipping cars just four years after its first vehicle hit the market. Initially cautious, Yin approved only 10 units for export, but as demand grew, shipments increased to over 500 within three years. By its fourth year, Chery had expanded to Egypt, Iraq, Algeria, and Lebanon.

By 2003, Chery had established an international division, while SAIC only upgraded its overseas business unit five years later. Mei attributes Chery’s early focus on exports to its ambition: “Chery started from a humble factory in Wuhu, but it always aimed to compete with Volkswagen and Toyota.”

Yin’s previous experience at FAW-Volkswagen influenced Chery’s global outlook. While many Chinese automakers focused solely on domestic growth, Yin saw overseas markets as an essential avenue for expansion. He identified emerging markets where consumers were less reliant on foreign brands, such as South America, Africa, and Central Asia.

His fluency in English also played a role in Chery’s global push. Videos of Yin speaking English at the 2024 Beijing Auto Show gained traction online, underscoring his direct engagement with international markets. “When a company leader isn’t afraid of global markets, the whole team follows suit,” Mei noted.

The company was the first Chinese automaker to establish an overseas assembly plant, partnering with Iran’s SKT in 2003. Over the years, Chery built 10 overseas production bases across Asia, Europe, Latin America, and Africa.

Another key pillar of Chery’s overseas success lies in its commitment to self-research, local production, and after-sales service.

In its early years, Chery’s supply chain was heavily reliant on Volkswagen, which made the company acutely aware of the importance of independently developing key components like engines and transmissions. With technological restrictions and trade sanctions becoming common geopolitical tools, emerging companies must anticipate long-term threats and mitigate operational risks.

To align its technological strategy with global standards, Chery hired veteran industrial experts whose international expertise played a crucial role in Chery’s global expansion.

Chery’s journey into self-research was not without challenges. According to Zhu Hang, then-General Manager of Chery’s Engine Division, breaking free from reliance on external suppliers was daunting. The company initially lacked complete engine blueprints, and organizing the production line posed a significant challenge. “We finally produced our first engine, but its performance and fuel efficiency were far from ideal. We had to keep improving,” Zhu recalled.

By tailoring models to local conditions—adjusting for climate, road conditions, and consumer preferences—Chery gained an edge over competitors. Analysts compare Chery’s approach to that of Korean automakers, which won over American consumers with extended warranty services.

Despite its rapid growth, Chery faces significant hurdles. While its exports thrive in emerging markets, it has yet to gain traction in Europe and North America. The U.S. has imposed 100% tariffs on Chinese-made EVs, and the EU is considering restrictions on Chinese auto imports.

Chery stands at a critical juncture. Having surpassed one million exports, its next challenge is securing a foothold in the world’s most competitive markets. As global geopolitics shift, the road ahead remains uncertain—but if history is any guide, Chery is prepared to take the risk.