Beyond price wars, a new battle for intelligent mobility has begun in the EV market.

by Zhou Shuqi

With BYD already leading China’s mass-market auto sector, the company is betting on smart technology to drive further growth. Even its most affordable model, the BYD Seagull, will now come equipped with at least highway navigation assist.

On February 10, the world’s top-selling EV maker unveiled three tiers of advanced driver assistance systems (ADAS) and announced that 21 models will adopt them. All models priced between 100,000 and 200,000 yuan (about USD 13700 to 27400) will come standard with ADAS, while even models around the 100,000 yuan price point like the Seagull and Qin PLUS DM-i will see widespread adoption of the technology.

In 2024, BYD fired the first shot in the industry’s price war. This year, it is taking the lead in making intelligent driving features more accessible in the 100,000 yuan market.

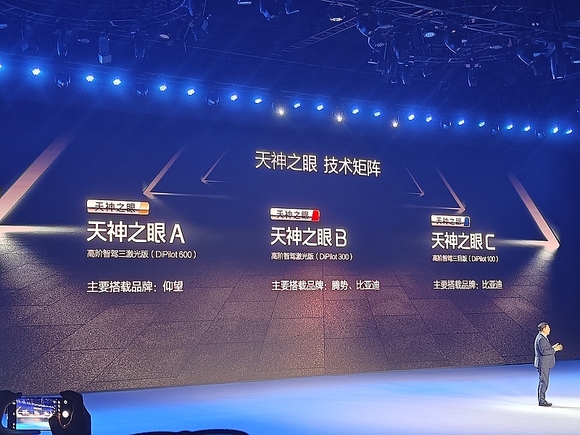

BYD’s three-tier ADAS solutions are distinguished by hardware capabilities. The top-tier DiPilot 600, featuring three lidar sensors, is designated for its luxury sub-brand, Yangwang. The mid-tier DiPilot 300, using one or two lidar sensors, will be installed in Denza and core BYD models. The entry-level DiPilot 100, a camera vision solution, will cover the affordable BYD lineup.

Jiemian News learned that the vision-based system is developed in-house and will be deployed across BYD’s mainstream sub-200,000 yuan models, which account for over 90% of its sales. Currently, ADAS in this price range is limited to basic adaptive cruise control (ACC) and lane centering (LCC). BYD aims to push adoption of L2+ navigation-on-autopilot (NOA), offering driving assistance that mimics human decision-making.

BYD Chairman Wang Chuanfu dismissed concerns about the company’s capabilities in smart technology, declaring that 2025 will mark the "year of mass-market ADAS", and predicting that within two to three years, advanced driver assistance will become a must-have feature.

The market responded enthusiastically. When BYD announced its ADAS strategy, its market capitalization surged by 82.2 billion yuan in a single day, with related suppliers like Yutong Optical, Bethel Automotive Safety System, ZYNP Corporation, and Lianchuang Electronics hitting daily limit-ups.

Several BYD employees told Jiemian News that since late last year, the company’s intelligent driving team underwent restructuring for closed-loop development, with performance bonuses encouraging overtime to accelerate deployment.

BYD took just 130 days from project approval in mid-September to internal quality validation in early February—a pace that exceeded internal expectations. Immediately after passing internal reviews, the company rushed to hold its smart driving strategy event, highlighting a tightly orchestrated timeline.

BYD’s push comes amid intensifying competition. Automakers like Geely and Chery have announced price cuts and partnerships with Huawei to strengthen their product appeal. Notably, Changan Auto preempted BYD’s event by one day, unveiling plans to introduce lidar-equipped models in the 100,000 yuan segment, a hardware feature typically reserved for higher-end vehicles.

The industry consensus is that smart features, not battery technology, will drive differentiation in the near term. However, cost concerns and uncertain consumer demand have slowed the spread of ADAS in lower-priced models.

Zhang Yichao, leader of AlixPartners‘ Greater China Automotive Sector, noted that ADAS adoption in the 100,000 yuan segment is highly cost-sensitive, requiring both efficient hardware choices and strong software optimization.

DJI Automotive, recognized for aggressive cost control, provides a 7,000 yuan ADAS package featuring seven cameras and 32 TOPS processing power. A BYD employee told Jiemian News that this serves as a benchmark for the company’s low-cost ADAS solution.

A Shanghai-based auto industry consultant with over 20 years of experience, who requested anonymity, told Jiemian News that BYD’s sales in the 200,000 yuan mass market segment are nearing saturation, making smart technology its key strategy to maintain and expand market share. He believes BYD is uniquely positioned to pioneer mass-market ADAS adoption due to its vertical integration and massive scale, which allow it to amortize costs effectively. Its extensive fleet also enables rapid data collection for algorithm training, accelerating development.

The mass deployment of high-level ADAS is expected to reshape consumer perceptions. This year, highway assist ADAS in models around the 100,000 yuan price point will become a baseline expectation, pressuring automakers without competitive smart driving capabilities.

McKinsey research highlights that ADAS-equipped vehicles serve as powerful word-of-mouth marketing tools—owners frequently share driving experiences online, generating free publicity. And analysts Jiemian News spoke to share the opinion that, while consumers may not yet buy a car for ADAS, they may avoid brands that lack the capacity for it.

BYD’s swift rollout also sends a psychological shockwave across the market. Zhang Yichao remarked that BYD, traditionally seen as a leader in EV battery technology, is now positioning itself as an intelligent mobility brand, "bringing it into the same circle as XPeng."

The Shanghai-based consultant noted that automakers competing in BYD’s segment have no choice but to follow suit or seek differentiation. He warned that companies with insufficient production and sales volumes may see further profit declines. According to his estimates, to break even on ADAS investments, automakers must scale production to at least 300,000–500,000 units.

Other companies are already responding. EV startup Leapmotor, known for high-end features at budget prices, has been closely tracking BYD’s ADAS rollout. Just ahead of BYD’s event, Leapmotor announced that its new 150,000 yuan B10 model will feature lidar and Qualcomm 8650 chips for urban ADAS. Geely is also preparing its own smart driving strategy release in March.

Multiple industry insiders Jiemian News spoke to share the opinion that 2025 will be a watershed year for ADAS adoption in lower price segments. Suppliers like Continental AG are shifting R&D focus toward mid-tier high-level ADAS solutions, with map-free urban driving assist set to debut this year.

According to McKinsey, Chinese consumers' exposure to and satisfaction with ADAS has surged in 2024, along with their willingness to upgrade. As adoption scales, costs will drop, driving high-level ADAS down from the 250,000 yuan segment into the 150,000–200,000 yuan range.

However, ADAS alone won’t determine success. Wu Zhao, a partner at Roland Berger, emphasized that consumers still prioritize brand, design, pricing, and dealership networks over ADAS capabilities.

Still, one thing is clear: beyond price wars, a new battle for intelligent mobility has begun in the EV market.