By the end of October, time deposits reached 73.9 percent, a record high, indicating significant economic and financial changes.

by Yang Zhijin

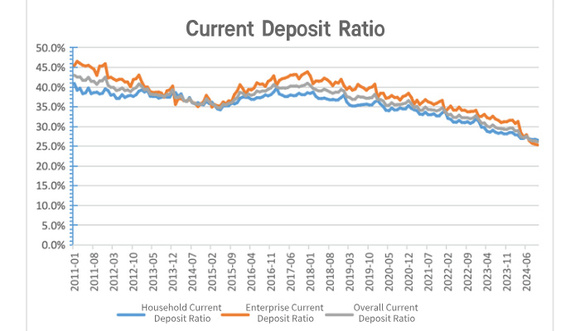

Latest data from the People's Bank of China (PBOC) highlights a significant shift in deposit structures across households and enterprises. As of the end of October, combined current deposits for these two sectors totaled 58.6 trillion yuan, accounting for 26.1 percent of total deposits—a historic low. Meanwhile, time deposits rose to 73.9 percent, a record high, reflecting broader economic and financial shifts.

The trend toward time deposits is attributed to the lingering impacts of the pandemic, which have influenced both households and enterprises. Households have prioritized early loan repayments and increased fixed savings, while enterprises, facing declining investment returns, have redirected surplus funds toward time deposits. Additionally, the shift comes amid growing volatility in wealth management product yields, prompting a reallocation of assets to more stable time deposits.

This "term-ization" of deposits has put pressure on commercial banks, affecting net interest margins, operating income, and net profits. On a macroeconomic level, it has slowed M1 growth due to weaker increases in enterprise current deposits, signaling a dip in economic vitality. However, M1 growth rebounded slightly in October, following the rollout of new economic policies, though structural deposit changes remain a key area to watch.

The shift is particularly evident in household deposits, where time deposits now account for 73 percent of total savings, up from 60 percent in 2017, while current deposits have fallen to 27 percent. As of October, household time deposits totaled 108.9 trillion yuan, increasing by 10 percentage points since 2019, with current deposits decreasing to 26.5 percent over the same period.

A similar trend is observed in enterprise deposits, where current deposits have steadily declined over the past five years, while time deposits have increased to 74.7 percent during the same period. However, driven by local debt swaps and rising real estate transactions, enterprise current deposits are expected to grow in the future, potentially boosting M1 growth.

The PBOC is also considering including household current deposits in the M1 calculation to bolster its scale. However, with household current deposits growing at just 4.3% year-on-year to 39.4 trillion yuan as of October, such a move may have limited impact on accelerating M1 growth. Analysts note that while October's growth was slightly higher than in January and September, it remained below other months this year, highlighting persistent challenges in boosting M1 momentum.

The evolving deposit structure underscores shifting financial behavior and its broader implications for China's banking sector and macroeconomic indicators.